OUR BLOG

not by default not byby

The Fed Speaks, Earnings Release, and the Market Drops… But Your Retirement Finances Shouldn’t Care

In recent months, the financial landscape has been marked by unpredictability. The Federal Reserve's recent announcement to maintain interest rates at their current levels has left many investors on edge. While the Fed has signaled a cautious approach, it has not ruled out the [...]

8 Woodworking Projects for Retirees

Woodworking offers retirees a fulfilling hobby that blends creativity with practicality. It's a great way to spend your free time creating beautiful and useful items for your home or as gifts. Here are some woodworking projects that can help retirees improve their skills and [...]

10 Actions That Help You Pursue Financial Wellness

Establishing financial wellness is a personal, ever-changing state of being that enables one to exercise choice while feeling in control of finances. The individual determines financial wellness, which often includes working toward financial goals by completing specific actions. Some actions are time-sensitive, but others [...]

How Pets Could Impact Your Taxes

Many view pets as part of their family and essential to their happiness and mental health. Pets can be an added expense as they may need special diets, require veterinary services, and in some cases, pet daycare. Pets are not considered dependents when it [...]

Retirement Readiness for Generation X: Overcoming the “Sandwich Generation” Squeeze

As a financial advisor, I've had the privilege of working with many clients from Generation X—the often-overlooked cohort born between 1965 and 1980. And I can say with certainty that this generation is facing some unique challenges when it comes to preparing for retirement. [...]

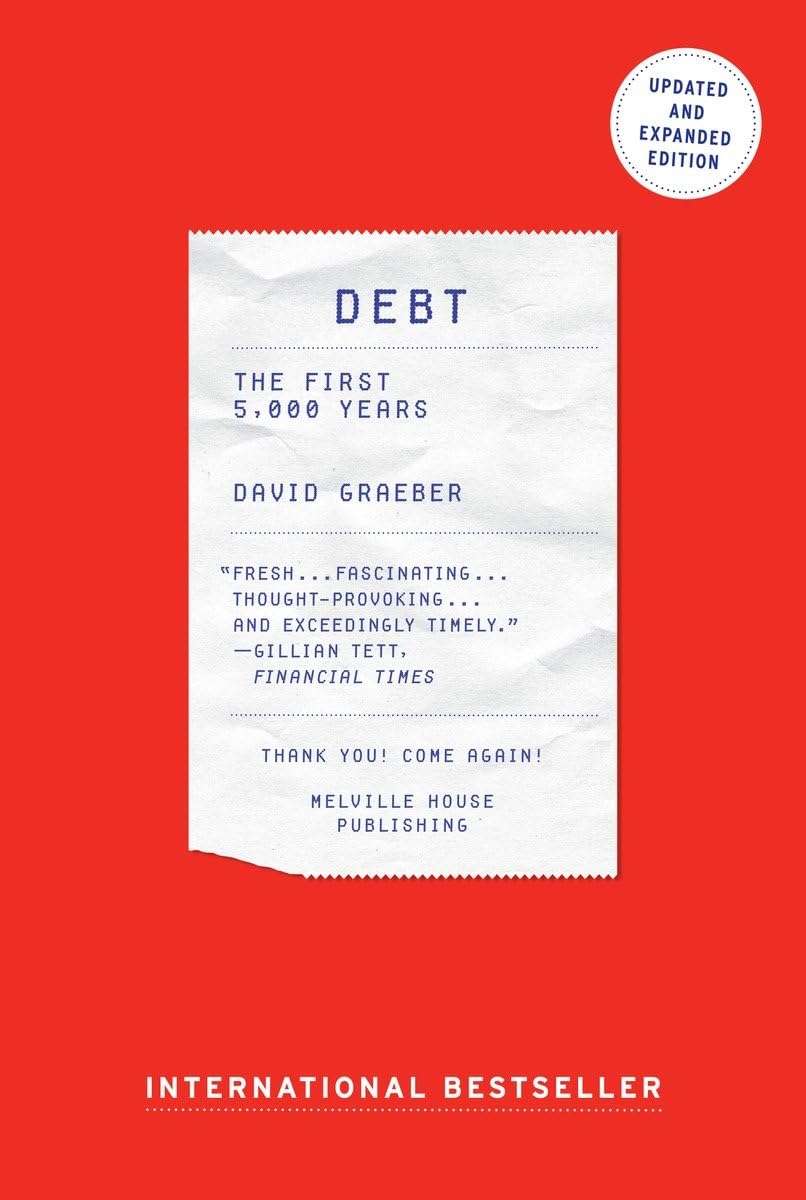

Book Review of Debt: The First 5,000 Years by David Graeber

Image source: https://www.amazon.com/Debt-Updated-Expanded-First-Years/dp/1612194192 Debt: The First 5,000 Years by David Graeber is a captivating journey through the global history of debt, credit, and money, offering a profound look at the concepts of debt and their impact on human relations, markets, and societies [...]

Covering New Tax Proposals From the “Project 2025” Agenda

Project 2025, a policy blueprint developed by the Heritage Foundation, has stirred significant attention due to its controversial tax proposals. This 900-page mandate from the conservative think tank outlines profound changes that could fundamentally alter the federal government, including the tax system. Here's what [...]

How to Prep Your Finances for a Last-Minute Summer Vacation

Summer vacation is a time of relaxation and fun. But sometimes, our plans can change abruptly, and we find ourselves planning a last-minute trip. Preparing your finances for this sudden expenditure is essential to avoid financial stress and enjoy your vacation fully. Here's how [...]

Tax Strategies: How to Lower Your Tax Bill in Retirement

Given the constantly fluctuating economic climate, developing strategic planning methods to ensure a comfortable retirement has become more critical than ever. One such strategy to complement this is tax planning. Effective tax planning before and during retirement can enhance the longevity of your retirement [...]

Published Articles

Zinnia Wealth Management and Charisse Rivers has been published and recognized by numerous industry publications.

Click below to read her articles.

Certain guides and content for publication were either co-authored or fully provided by third party marketing firms. Zinnia Wealth Management utilizes third party marketing and public relation firms to assist in securing media appearances, for securing interviews, to provide suggested content for radio, for article placements, and other supporting services.

STAY UP TO DATE WITH CHARISSE

Receive our timely strategies, tools, checklists, and more to your inbox each week.