OUR BLOG

not by default not byby

The History of Inflation is Older Than you Think

Inflation has occurred in many different societies throughout history. We think of inflation as a modern economic concept, but in reality, it predates modern history and has been a prevalent part of societies since the first nations and urban areas emerged. Ancient Rome When silver [...]

Going “Back to School” on Your Retirement Plan

When you think about your school years, whether your high school, college, or post-grad days, you’ll revisit memorable moments from when you had your whole life ahead of you. Schooling is all about providing students with the tools they need to achieve their future [...]

A Movie Marathon for a Fun Night In!

Retirement is a time to do more of what you love, whether that’s through an active hobby like hiking or through sports like tennis and golf, or if it’s a relaxing activity like reading, writing, or embracing your creative side with the arts and [...]

3 Strikes to Avoid When Tax Planning

Taxes are among the most common concern for people in retirement. You might be wondering how to start thinking about your tax strategy so you aren’t taxed more than you need to be. These three mistakes can help start the conversation about what a [...]

Traveling in Retirement on a Budget

Retiring is a lifetime achievement marking a new chapter of exploration, journey, and relaxation. That’s why so many retirees choose to travel when they enter retirement! But affording the retirement you planned for isn’t a walk in the park, especially nowadays with inflation affecting [...]

5 Key Components to the Retirement Bucket Strategy

Saving for retirement is a long-term endeavor. It’s not about finding the next hottest stock or trying to get rich quickly. It requires a different perspective on your wealth and income that accounts for your needs in different stages of your life, from the [...]

Earth Shoes and Other Products of the 70s

If you think some of the products your kids or grandkids have are strange, consider what was around in the 70s – pet rocks and beer shampoo. The 70s certainly saw some interesting trends. You may even have a few of these artifacts somewhere [...]

4 Easy-to-Overlook Estate Planning Mistakes

It’s easy to avoid making an estate plan, but not having one won’t be easy on your loved ones. Having your affairs in order can greatly help your family, so consider creating a comprehensive estate plan. Unfortunately, there are many easy-to-overlook estate planning mistakes, [...]

What Is a QCD and How Does It Work?

You might expect your tax burden to decrease in retirement – after all, you’re no longer receiving a paycheck that incurs income tax, payroll tax, and Medicare tax. However, your income in retirement could be significant between investment income, rental properties, pensions, Social Security, [...]

Published Articles

Zinnia Wealth Management and Charisse Rivers has been published and recognized by numerous industry publications.

Click below to read her articles.

Certain guides and content for publication were either co-authored or fully provided by third party marketing firms. Zinnia Wealth Management utilizes third party marketing and public relation firms to assist in securing media appearances, for securing interviews, to provide suggested content for radio, for article placements, and other supporting services.

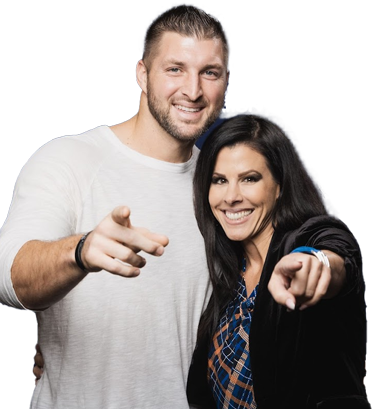

STAY UP TO DATE WITH CHARISSE

Receive our timely strategies, tools, checklists, and more to your inbox each week.