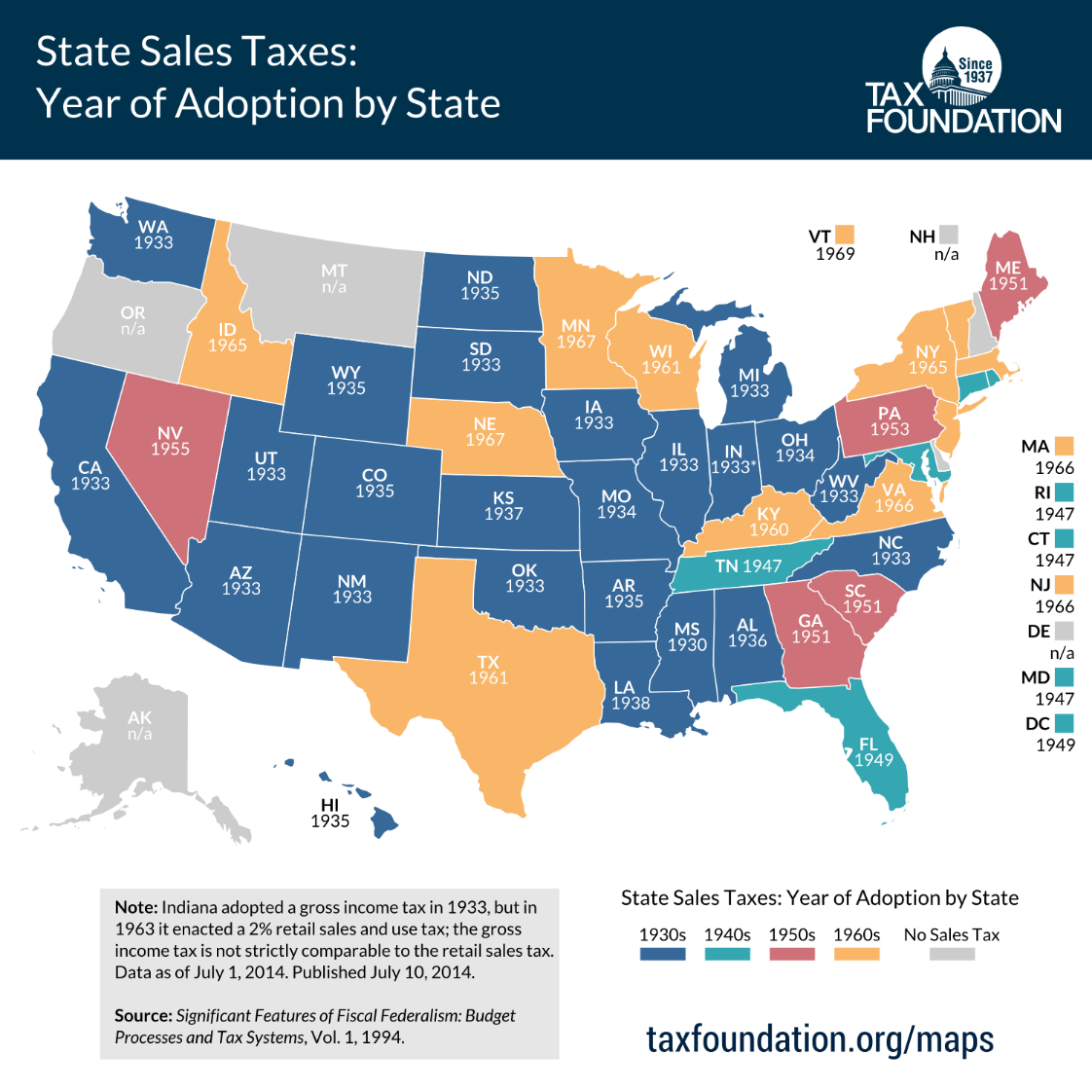

A History of the Sales Tax

Before we take a peek into the past to see how sales tax became a part of our lives, let’s define our terms. Sales tax is a tax on the sale or exchange of an item or service and is usually paid by the consumer or purchaser. It is a source of revenue for state [...]